(file photo)

(file photo)

By The Maritime Executive 06-08-2020 10:21:49

Container shipping lines’ ability to provide cargo space showed a marginal improvement in 2019, according to the fourth annual shipper satisfaction survey conducted by Drewry and the European Shippers’ Council (ESC).

While the survey reported positive trends in 2019, it noted that the impact of the coronavirus on container shipping operations — with blanked sailings and ships operating slower sailings to save on costs — was likely to dramatically reversed the gain by mid-year 2020.

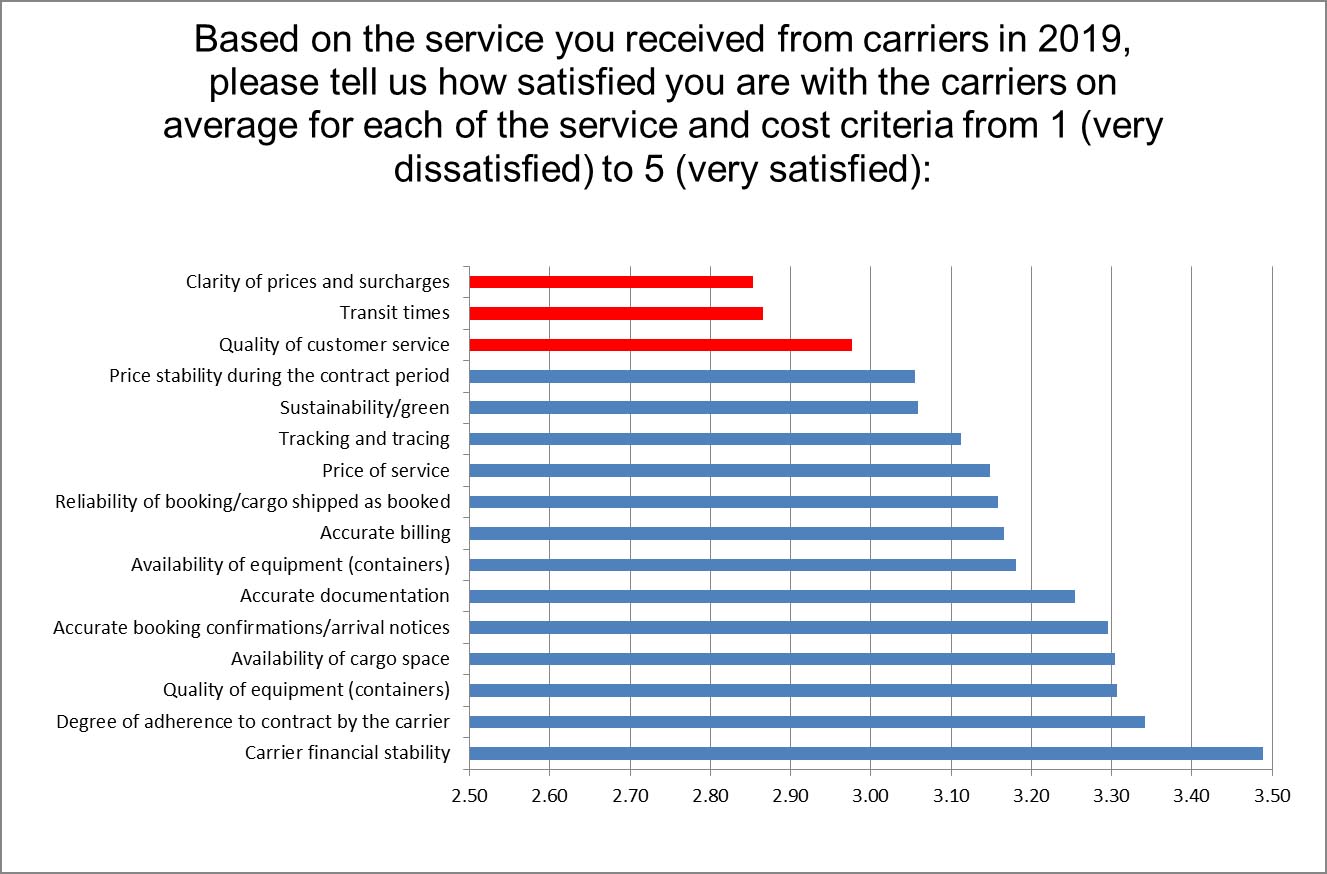

The survey, which included 227 shippers and forwarders, explored the level of satisfaction for 16 different carrier service and cost criteria for the container shipping lines. Overall the shippers and forwarders gave the container shipping lines a slightly positive score of 3.2 for the service (on a scale of 1 to 5).

The availability of cargo space was ranked as the most important criterion by shippers and forwarders. Respondents said that availability had improved in 2019 versus 2018 giving it a 3.3 satisfaction score up slightly from 3.2 in 2018. Carrier performance related to sustainability/green and carrier financial stability also improved in 2019, according to respondents.

“This is a market with volatile capacity where liners remain price setters and keep freight rates high, despite very low fuel indexes, whilst they can only plan in the short term themselves,” said Godfried Smit, Secretary General of the European Shippers’ Council. “Our view is that shippers will benefit from shorter-term contracts, and either by diversifying their carriers’ selection pool or by concentrating more on financially healthier or government supported carriers.”

Among the areas that shippers and forwarders gave the lowest satisfaction to was the clarity of prices and surcharges, transit times and quality of customer service (receiving scores of 2.8 to 3 for 2019.)

Shippers and forwarders also said that carrier performance has deteriorated between 2018 and 2019 in four areas: the range of different available carriers, the range of different available services, the price of service and the overall carrier service quality.

“Drewry foresees that the next survey will show growing concerns among shippers for three specific areas of service quality: availability of space and equipment, reliability of bookings and carriers’ financial stability,” said Philip Damas, head of the logistics practice at Drewry. “These are key factors of carrier and forwarder selection particularly in today’s disrupted market, but also in the next year as and when ocean-borne volumes recover.”

Among the issues that they believe will have the great impact of shippers satisfaction is the growing number of canceled sailings in 2020. Following the coronavirus outbreak, they cited that over 280 Asia-Europe and Asia-North America sailings have been cancelled resulting in a dramatic decrease in the availability of cargo space for shippers and forwarders.

Recently many of the major shipping lines released further schedules of blanked sailing meaning the issues of availability of cargo space will likely to continue to impact shippers going forward into the second half of 2020.

source: www.maritime-executive.com