file photo_x000D_

file photo_x000D_

By MarEx 2018-10-21 19:30:43

_x000D_

Global natural gas markets are being reshaped by the development of major emerging LNG buyers led by China, and the rising production and exports form the U.S., according to the third annual edition of the International Energy Agency’s Global Gas Security Review.

China’s supply shortfall over the last winter, which triggered ripple effects around the world, highlighted the pivotal role of LNG in enhancing global gas security and flexibility of supply, and the analysis finds that, while there have been real improvements in LNG flexibility that can contribute to easing supply shortages, uncertainties remain for the future evolution of gas markets. This includes a risk of tightening from insufficient investment in production and infrastructure capacity, or questions surrounding future shipping capacity growth, a pre-condition for LNG market flexibility. These uncertainties could have an impact on price volatility and hurt consumers – especially the most price-sensitive emerging buyers – and cause additional security concerns.

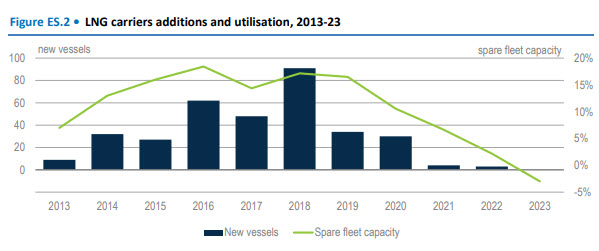

The report also states that the risk of a lack of timely investment in the LNG carrier fleet could pose a threat to market development and security of supply. Once considered as a non-flexible complement supporting long-term sales and purchase agreements, the LNG carrier fleet is being affected by changes in the LNG market, with increasing demand for flexibility in supply and contracts of shorter duration. Such changes challenge the traditional LNG shipping business model, with greater uncertainty in medium-term fleet development and availability, and potential impacts on shipping price levels and volatility.

_x000D_

The wave of liquefaction projects development from investment decisions taken in the first half of this decade led to a strong level of new vessel deliveries, which ebbs after reaching a peak in 2018. The absence of further growth of the LNG fleet poses a limit to future trade development both in terms of volume and flexibility delivery.

_x000D_

Supply flexibility remains a key prerequisite to ensure further global gas trade development and security, states the report. Yet the priorities in terms of flexibility differ for long-term traditional buyers who seek the removal of destination clauses, and new emerging buyers whose priority is more focused on procuring short-term supply, usually for prompt execution.

_x000D_

source: www.maritime-executive.com

_x000D_

_x000D_

_x000D_